Newsletter – January 2025

The Share Market

Australia – ASX 200

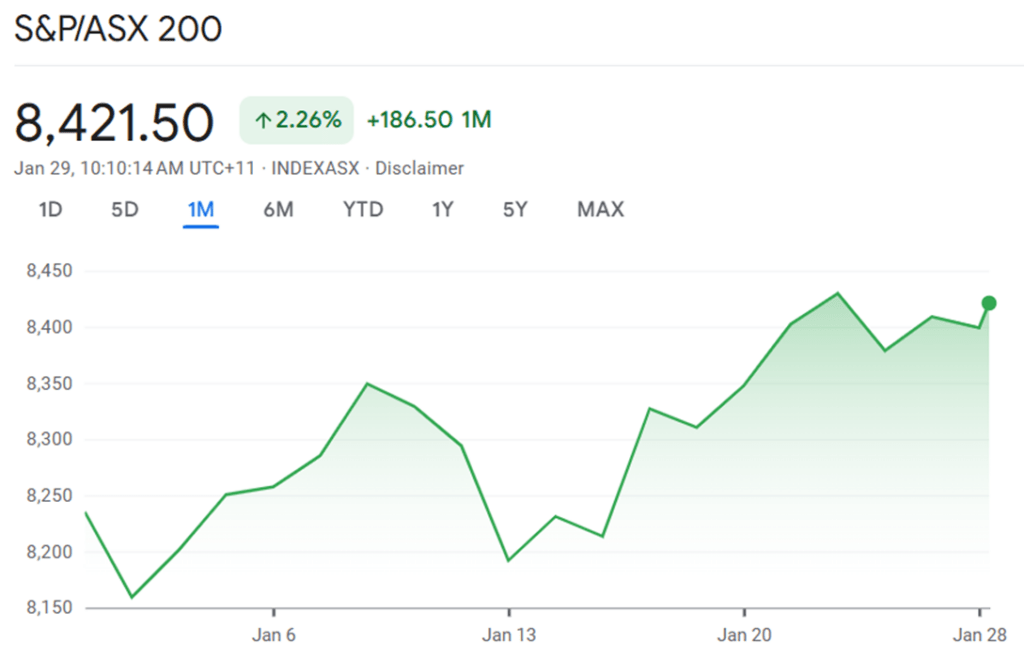

The ASX 200, Australia's benchmark stock index, has shown a robust performance in January 2025, demonstrating resilience and growth amidst global economic uncertainties. As of 29 January, the index stands at 8,421.50, marking a significant 2.26% increase (+186.50 points) over the past month.

The index kicked off the year around the 8,150 mark and has steadily climbed throughout January. This upward trajectory wasn't without its challenges, however. Mid-month, around 13 January, the market experienced a noticeable dip, with the index dropping close to 8,200. This temporary setback might be attributed to global economic factors or specific Australian market conditions.

Despite this brief downturn, the ASX 200 demonstrated remarkable resilience. The market swiftly recovered, embarking on a steady ascent that saw it surpass the 8,400 threshold towards the month's end. This recovery and subsequent growth likely reflect positive investor sentiment and favourable economic indicators.

Several factors may have contributed to this positive trend. The technology sector, influenced by U.S. spending plans on artificial intelligence infrastructure, has shown strength. This global tech optimism seems to have spilled over into the Australian market, potentially driving some of the growth.

However, it's worth noting that the ASX 200's performance isn't uniform across all sectors. While tech stocks have rallied, major mining and banking sectors have faced some challenges. The mention of potential tariffs on China by U.S. President Trump has particularly impacted mining stocks, highlighting the interconnected nature of global markets.

USA – S&P 500

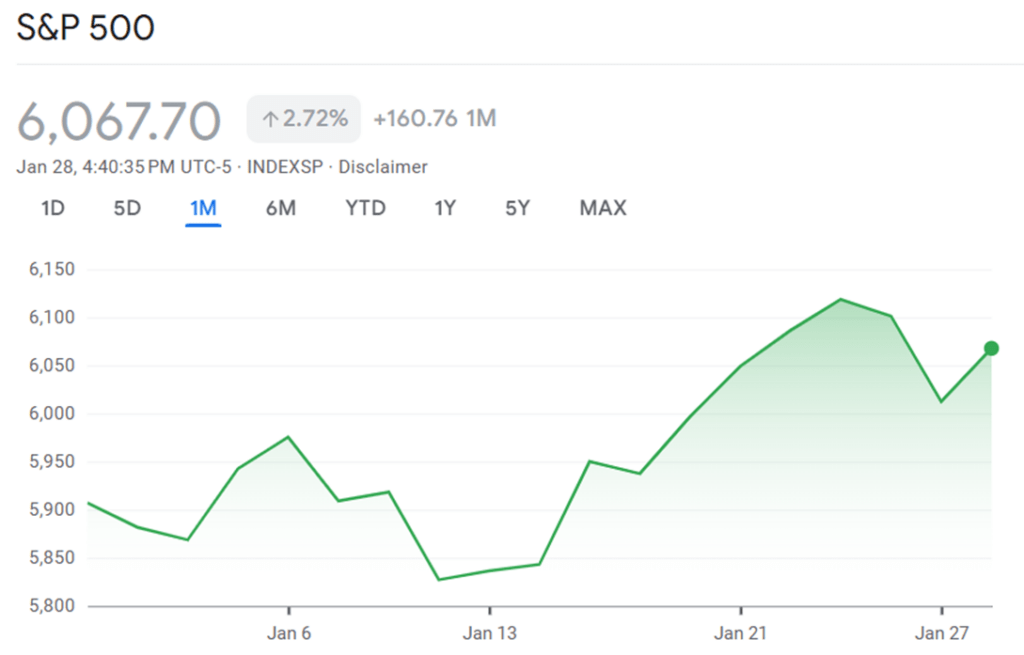

While the ASX 200 has shown robust performance, its American counterpart, the S&P 500, has also demonstrated remarkable strength in January 2025. As of 28 January, the S&P 500 closed at 6,067.70, marking a significant 2.72% increase (+160.76 points) over the past month.

The S&P 500's journey through January has been characterised by an overall upward trend, albeit with notable fluctuations. The index kicked off the year around 5,900 and has steadily climbed above the 6,000 mark. This ascent, however, wasn't without its challenges.

Early January saw a slight initial decline, followed by a quick rebound that pushed the index near 5,950 by 6 January. The market then faced a significant hurdle mid-month, with a notable dip around 13 January that brought the index close to 5,820. This temporary setback might be attributed to profit-taking or concerns about potential changes in US economic policies.

However, the S&P 500 demonstrated remarkable resilience, staging a strong recovery in the latter half of the month. The index surged upward, reaching a peak above 6,100 around 24 January. This robust performance can be largely attributed to the technology sector, particularly companies involved in artificial intelligence (AI).

The AI boom has been a significant driver of the S&P 500's growth. Companies like Nvidia have seen substantial gains, with the stock up by 61.5% since the beginning of the year. The announcement of a $500 billion AI infrastructure project involving Oracle, OpenAI, and SoftBank further fuelled the tech rally.

However, the market's enthusiasm for AI stocks also led to some volatility. Concerns about the rise of Chinese startup DeepSeek and its potential impact on the AI sector caused a sharp downturn in tech stocks towards the end of the month. Nvidia, for instance, experienced a significant drop, losing nearly $600 billion in market capitalisation in a single day.

Despite these fluctuations, the S&P 500 has maintained its upward trajectory. The index's performance has been bolstered by strong economic data, with US growth remaining resilient despite high borrowing costs. Additionally, the Federal Reserve's decision to cut rates by 25 basis points in December, bringing the target range to 4.25% - 4.50%, has provided further support to the market.

Looking Ahead

Market analysts offer varied predictions for both the ASX 200 and S&P 500 in 2025. For the ASX 200, Morgan Stanley forecasts the index to reach about 8,500 points by year-end, while Dr Shane Oliver from AMP Ltd predicts a climb to 8,800 points, albeit with potential volatility. For the S&P 500, Morgan Stanley's Mike Wilson has set a year-end target of 6,500, implying a modest increase of around 7% from current levels.

These forecasts, combined with January's performance, paint a picture of cautious optimism for both markets in 2025. While both indices have shown strength, investors should remain mindful of potential headwinds, including global trade tensions, interest rate policies, and sector-specific challenges.

As we move further into the year, market participants will be keenly watching how these trends develop. The Federal Open Market Committee (FOMC) meeting on 30 January will be important in shaping market sentiment, particularly regarding the Fed's outlook on future rate cuts.

Additionally, investors will be closely monitoring how global economic factors and technological advancements, especially in AI, continue to influence both Australia's and America's premier stock indices.

In conclusion, both the ASX 200 and S&P 500 have demonstrated resilience and growth in January 2025. As global markets continue to navigate economic uncertainties, the performance of these indices will likely remain intertwined, reflecting the increasingly interconnected nature of international financial markets.

The Residential Property Market

The Australian residential property market ended 2024 on a softer note, with national home values recording their first decline in almost two years. This shift marks a turning point in what has been a surprisingly resilient period of growth amidst high interest rates and cost of living pressures. Let's review some of the significant highlights from the January 2025 CoreLogic HVI report.

Overview of Home Values

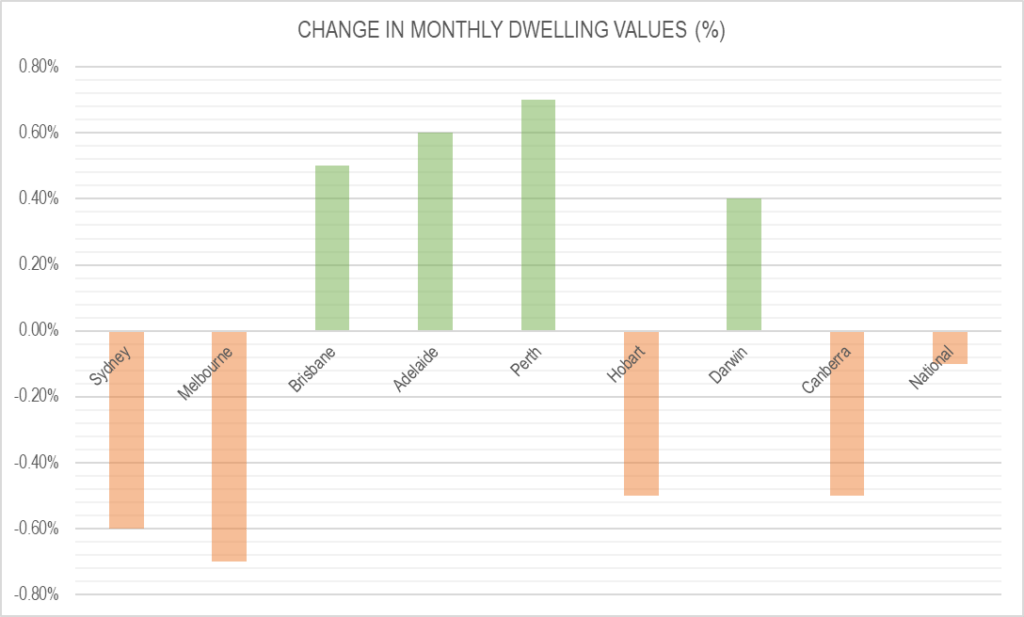

CoreLogic's Home Value Index (HVI) reported a -0.1% decline in national home values for December 2024, dragging the quarterly change into negative territory. This modest decline brought the annual growth for 2024 to 4.9%, adding approximately $38,000 to the median value of a home across Australia.

Capital City Performance

Sydney and Melbourne: Both cities experienced declines, with Sydney values dropping -0.6% and Melbourne -0.7% in December.

Brisbane, Adelaide, and Perth: These mid-sized capitals continued to show strength, with Perth leading annual growth at 19.1%, followed by Adelaide at 13.1% and Brisbane at 11.2%.

Hobart, Darwin, and Canberra: Hobart and Canberra saw slight declines, while Darwin managed a small increase.

Regional Markets

Regional housing markets finished the year more robustly than their capital city counterparts, with values up 6.0% over the year compared to 4.5% across the combined capitals. Regional areas of Western Australia, South Australia, and Queensland showed particularly strong performance.

Rental Market

The rental market also showed signs of cooling, with the national rental index up just 0.1% in December and 4.8% over the calendar year. This represents the smallest December quarter rise in rents since 2018, likely due to reduced net overseas migration and ongoing rental affordability challenges.

Looking Ahead

As we move into 2025, several factors are likely to shape the property market:

- Interest Rates: Financial markets are anticipating potential rate cuts in 2025, which could bolster housing demand. According to ASX cash rate futures, a 25-basis point cut is fully priced in by April, with expectations of 77 basis points worth of cuts throughout the 2025 calendar year.

- Migration: Net overseas migration is expected to wind down further, potentially easing rental demand.

- Housing Supply: The shortage of newly built housing is likely to persist through 2025, potentially supporting housing values.

- Affordability: There's potential for improved housing affordability in 2025 as value growth stalls and incomes rise. After a marked deterioration in housing affordability in 2024, several factors could contribute to improvement:

- Income growth outpacing growth in housing values

- Anticipated reduction in interest rates

- Stabilisation or potential decrease in rents

- Lower cost of living pressures providing additional capacity for housing

While the start of 2025 may be soft, the year could see varied conditions across different markets. The potential for interest rate cuts and changes in macroprudential policies will be key factors to watch. Macroprudential policies are a set of financial regulations that aim to keep the financial system stable. A common example is Debt-to-income restrictions which imit the amount a household can borrow relative to their income.

Overall, the Australian residential property market is showing signs of moderation after a period of strong growth, with regional variations continuing to play a significant role in market dynamics.

Inflation and Interest Rates

The Reserve Bank of Australia (RBA) has maintained the cash rate at 4.35% since December 2024, continuing its cautious approach. This decision comes as inflation shows signs of easing, with consumer inflation expectations falling to 4% in January, down from 4.2% in December 2024. In other words, people expect prices to rise by about 4% this year, which is less than they thought before.

The most recent official data, from Q3 2024, showed the annual inflation rate had dropped to 2.8%, while the trimmed mean CPI (which is thought to provide a better signal of the underlying inflation trend) stood at 3.5% year-on-year. Although still above the RBA's 2-3% target range, this represents the softest increase in nearly three years.

The Australian Dollar's Decline

The Australian dollar has become a bit cheaper compared to other currencies, especially the US dollar. It's now worth about 61.5 US cents, which is quite a drop of about 10%. If we look at it relative to our exports to other countries, the decline is less severe at about 5%.

This means it's more expensive for Australians to buy things from overseas, but it might help our exports because they're cheaper for other countries to buy. What this means for Australians:

- Shopping: Imported goods might become a bit pricier, but local products might not change much.

- Travel: Overseas holidays could be more expensive, but Australia might attract more tourists.

- Savings and Loans: Interest rates on savings accounts and loans are likely to stay about the same for now.

Economic Outlook and Predictions

Despite the falling dollar, ANZ Research has brought forward its forecast for the first interest rate cut to February 2025, citing softer-than-expected inflation data. Major banks have varying predictions for rate cuts in 2025, with Commonwealth Bank being the most optimistic.

The labour market continues to show resilience, which could potentially influence the RBA's decision-making. However, the RBA is likely to focus more on whether inflation is decreasing quickly enough and on labour market data, rather than the exchange rate.

Conclusion

As Australia navigates these economic waters, the interplay between interest rates, inflation, and currency value remains complex. While the falling Australian dollar presents challenges, its impact on inflation and interest rates may be less significant than initially feared. The RBA's upcoming decisions will be closely watched as it balances the need to control inflation with supporting economic growth.