October 2025 Market Updates

The Share Market

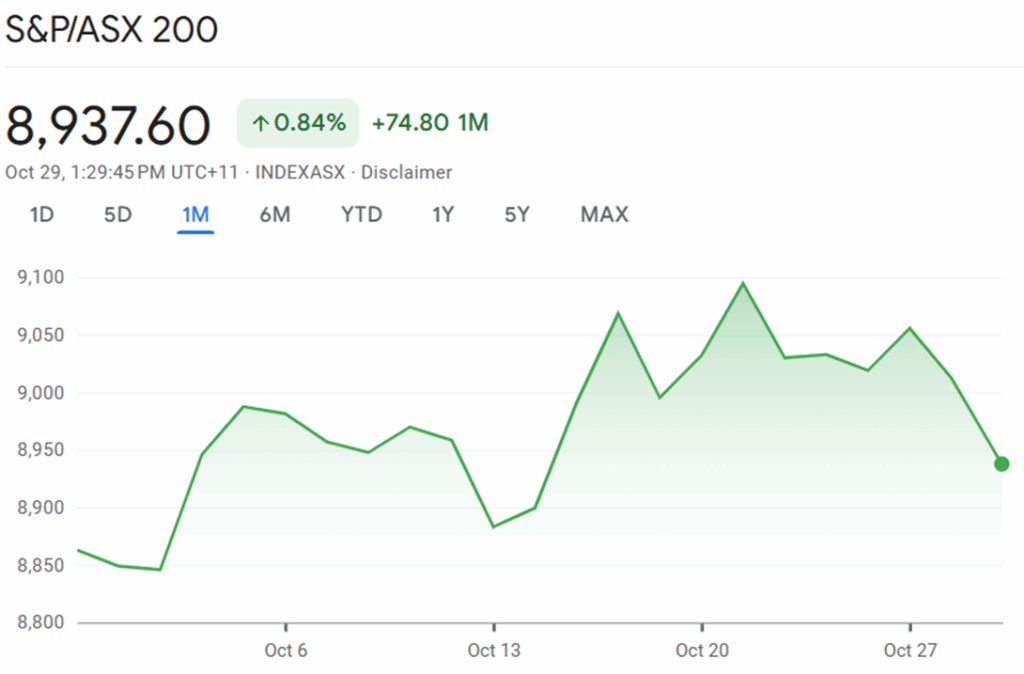

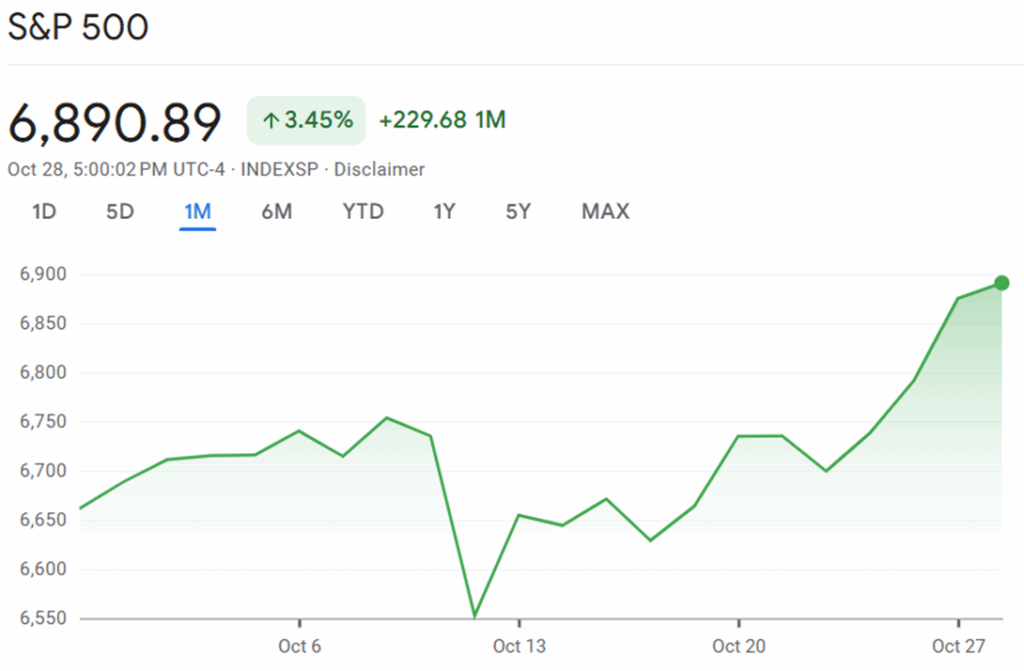

The S&P/ASX 200 in October 2025 delivered modest growth, with its closing value for the month sitting at 8,937.60, reflecting an increase of 0.84% or 74.80 points over the period. Meanwhile, the S&P 500 in the United States posted far more robust gains, ending the month at 6,890.89, up 3.45% or 229.68 points. The diverging paths of these two markets stemmed from contrasting local developments and global influences impacting sentiment and momentum.

ASX 200

October opened with the ASX 200 near the 8,850 mark. Early-month trading saw a rally, buoyed by optimism for a potential deal in US-China trade talks and positive cues from international markets. This drove the index toward 9,000 points by the end of the first week. Energy and information technology stocks were particularly strong, helping to underpin the initial momentum. However, the market saw notable swings as the month progressed, with several days of sharp declines in well-known stocks like WiseTech and CSL, amplified by a sector-wide drop in tech and rare earth shares. A substantial dip around mid-October brought the index back below 8,900, but a late rally in select sectors — especially industrials — helped counter some losses.

Source: Google Finance

Throughout the month, investors weighed the prospects of an imminent Reserve Bank of Australia (RBA) interest rate cut, particularly as inflationary signals remained mixed. The potential for a reducing rate environment lent a degree of support to equities, but caution was evident amid concerns about a slowing local labour market. The outlook for energy companies darkened due to a steep fall in oil prices after OPEC signalled possible revisions to output plans, dragging the broader index temporarily lower. Despite intraday rebounds driven by gains on Wall Street — where sentiment was more robust — the ASX 200’s performance remained choppy, closing the month off its highs as profit-taking and international market risks re-emerged in the final week.

S&P 500

The mood in the United States was substantially more upbeat. The S&P 500’s trajectory through October was marked by a swift rebound and a powerful uptrend, driven largely by an ongoing rally in mega-cap tech stocks and enthusiasm for artificial intelligence themes. The Federal Reserve’s indications of a likely 25 basis point interest rate cut added fresh impetus, with inflation data continuing to ease and GDP figures showing sturdy expansion. These macro signals encouraged strong inflows into US equities, further fuelling gains throughout the final two weeks. While price action was not uniformly bullish — early October saw brief pullbacks amid profit-taking and sector rotations — the broader direction was unmistakably higher.

Q3 corporate earnings season played a strong supporting role, with headline growth figures from the likes of Advanced Micro Devices, Microsoft, and Alphabet bolstering confidence. New records for the S&P 500 and Nasdaq were set mid-month, even as market commentary warned that the index was “statistically expensive” and trading at valuations above its historical averages. The limited impact of the ongoing US government shutdown on official data releases, along with encouraging regional surveys and consumer confidence readings, kept hopes high for the US economy and equity market. By month’s end, the S&P 500 was near new peaks, closing the month with its highest one-month gain in several quarters.

Comparing the Markets

While both the ASX 200 and S&P 500 saw positive monthly gains for October 2025, the nature and scale of their advances diverged for several reasons. The S&P 500’s advance was turbocharged by large technology and consumer stocks, underpinned by US-centric growth stories and the tailwind of imminent rate cuts. Conversely, the Australian market, while lifted by global optimism, faced dampening influences from volatile commodity prices and uncertainty around domestic economic readings, as well as the underperformance of heavyweights in healthcare and technology.

Macro policy divergence also played a role. The US’s clearer path toward rate cuts stood in contrast to the RBA’s more cautious stance, where mixed inflation and labour data led to greater hesitancy. The differing currency and commodity landscapes — especially falling oil, which weighs more heavily on the ASX 200 given its sector composition — also contributed to ASX underperformance relative to the US market. While the US rallied on a “risk-on” mood and a belief in resilient corporate earnings, Australia’s gains were more tentative and interspersed with sharp reversals, highlighting the differing risk appetites and sectoral drivers.

Outlook and Reflections

October 2025 highlighted the ongoing flux in global markets as investors in Australia and the US responded to both local policy cues and international developments. The S&P 500 surged, reflecting strong investor confidence in the US growth story and supportive policy signals, while the ASX 200’s gains were more restrained, driven by a balance of positive risk sentiment against domestic caution and sector volatility. This divergence underscores the significance of local conditions alongside global dynamics when assessing market performance.

Global economic prospects remain subdued, with modestly lower growth expectations and persistent uncertainties heading into year-end. Despite these headwinds, the Australian market demonstrated notable resilience, though highly sensitive to commodity price swings and geopolitical events, whereas the US market maintained its upward momentum, propelled by easing inflation and optimistic corporate earnings. The contrast between these markets offers a vivid example of the complexity and diversity underpinning world equity markets in 2025.

Moreover, heightened geopolitical tensions added a layer of unpredictability, influencing investor sentiment and spurring periodic volatility. Trade disputes, regional conflicts, and policy shifts played a critical role, particularly for the ASX 200 which felt the impact through its resource sectors. The late-month easing of US-China trade tensions brought some relief but also highlighted that geopolitical risks remain a persistent influence. Ultimately, October reiterated that market outcomes hinge not only on economic fundamentals but also on global political developments, reinforcing the need for agility, diversification, and a broad perspective for investors in both countries as the year closes.

The Residential Property Market

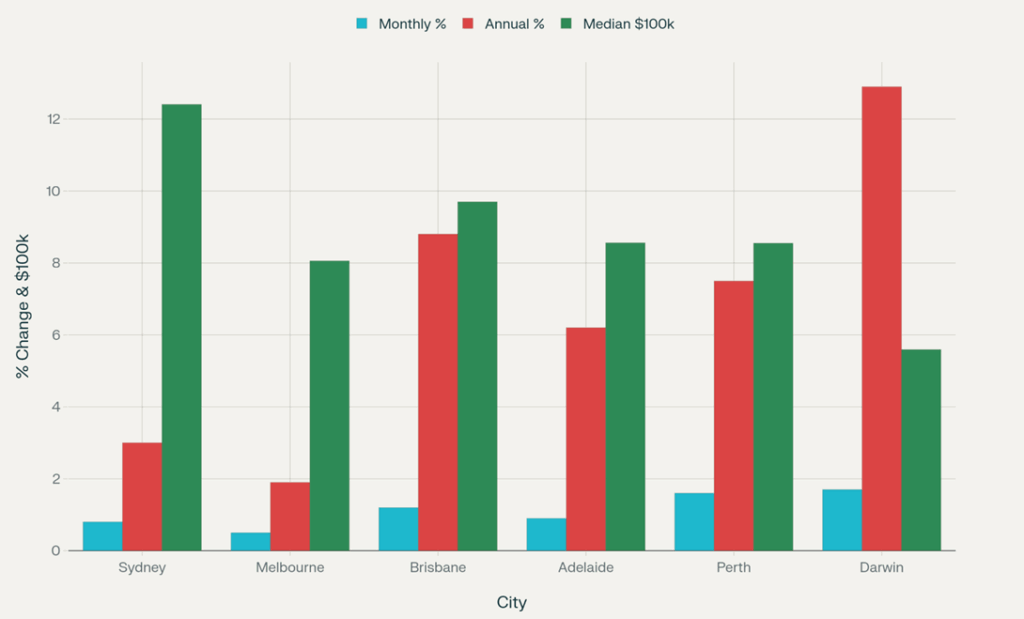

Australian residential property saw strong growth from September to October 2025, with national prices rising and tight supply fuelling competition in both capital cities and regional areas, as reported in Cotality’s October 2025 Home Value Index. This spring’s market was marked by record-low listings, surging buyer demand, and renewed optimism on the back of lower interest rates and improved economic sentiment.

Price Growth and Regional Standouts

| City | Monthly Change (%) | Annual Change (%) | Median Value ($) |

| Sydney | 0.8 | 3.0 | 1,241,054 |

| Melbourne | 0.5 | 1.9 | 805,880 |

| Brisbane | 1.2 | 8.8 | 969,868 |

| Adelaide | 0.9 | 6.2 | 855,998 |

| Perth | 1.6 | 7.5 | 855,267 |

| Darwin | 1.7 | 12.9 | 558,595 |

Source: Cotality’s October 2025 Home Value Index

Home prices across Australia rose by 0.8% nationally in September, with capital cities gaining 0.9% over the month and regional areas up by 0.7%. On a quarterly basis, the national Home Value Index (HVI) increased 2.2%, equivalent to a $18,000 lift in the median dwelling value. Every capital and region recorded growth, although Perth, Brisbane, and Darwin pulled ahead — especially in the unit market, which saw sustained momentum due to acute supply shortages. For example, Brisbane’s unit prices have consistently outpaced house prices for seven straight quarters, while Darwin’s dwelling values jumped 5.9% over three months.

Supply Shortage and Market Dynamics

Advertised stock levels in September were well below average in every capital, particularly severe in Darwin (-53%), Perth (-45%), and Brisbane (-31%). Over the September quarter, sales activity ran 7.3% above the five-year average, leading to highly competitive selling conditions and auction clearance rates around 70%, up from roughly 63% in June. This imbalance between supply and demand has led to robust price increases, especially in the lower and middle market tiers, partially driven by increased borrowing capacity as the Reserve Bank’s rate cuts took effect.

Rental Market Trends

Rental vacancies remained scarce — just 1.4% nationally in September — while advertised rental listings tracked 25% below the five-year average. Rents crept up, with Darwin, Hobart, and Perth seeing the strongest quarterly growth; however, home values still rose faster than rents, causing gross yields to soften slightly (nationally at 3.65% in September). Advertised rental stock and affordability constraints continue to be watched closely, given their impact on inflation and CPI measures.

Policy and Affordability

Interest rate cuts in 2025 boosted consumer sentiment and borrowing capacity, with the median household income now enabling 7% more borrowing power since early in the year. The expanded Home Deposit Guarantee Scheme, which launched in October, allows buyers to enter with a 5% deposit and no LMI, intensifying competition in areas under the new price caps. Even so, stretched affordability remains a challenge — Sydney’s dwelling value to income ratio hovered at 9.6, just shy of record highs.

Suburb Leaders and Regional Growth

Brisbane, Adelaide, and Perth led the gains for both capital and regional suburbs, with Darwin and several Western Australian and Queensland regional centres experiencing the highest annual growth rates. Notably, over 93% of suburbs nationally still have unit median values under the price caps — but higher demand may test these limits in coming months. In Greater Sydney, suburbs like Marrickville and St Marys posted annual increases over 7%, while Frankston and Mornington Peninsula topped Melbourne’s growth rankings.

Outlook

Australia’s residential market looks set to remain buoyant through spring and the end of 2025, with vendors benefitting from low supply and heightened buyer demand. While affordability and rate settings will continue to shape buyer behaviour, the market’s resilience — driven by policy support and economic recovery — suggests continued moderate growth as we move towards summer.

Inflation and Interest Rates

Australia’s inflation rose to 3.2% in the September 2025 quarter, pushing underlying inflation to 3.0% and effectively ruling out hopes of an interest rate cut in November. The Reserve Bank of Australia (RBA) has kept the cash rate at 3.6%, with markets now expecting rates to remain on hold until at least early 2026.

The latest figures from the Australian Bureau of Statistics show that headline inflation climbed to 3.2% year-on-year in the September quarter, up from 2.1% in June. This was the sharpest quarterly rise since early 2023, with the Consumer Price Index (CPI) increasing by 1.3% in just three months.

- Electricity costs were the largest contributor, rising 9% in the quarter and more than 23% over the year as temporary rebates expired.

- Food prices also added pressure, with meals out and takeaway food up 3.3% compared with a year earlier.

- The trimmed mean CPI, the RBA’s preferred measure of underlying inflation, rose to 3.0%, the top of its 2–3% target band.

This reversal comes after inflation had eased earlier in 2025, briefly giving households and businesses hope that price pressures were under control. Instead, the September data confirmed that inflation remains “sticky”, particularly in services such as insurance, healthcare, and housing.

The RBA had cut rates twice earlier in 2025, bringing the cash rate down to 3.6% in August. At the time, the Bank judged that inflation was trending back towards its target and that the labour market was softening.

However, the September inflation data has derailed expectations of another cut on Melbourne Cup day. Markets had priced in a 40% chance of a November reduction before the CPI release, but those odds collapsed to just 11% afterwards.

- Current cash rate: 3.6% (unchanged since August 2025)

- Market outlook: No further cuts expected in 2025; possible easing in early 2026 if inflation moderates

- RBA’s challenge: Balancing higher-than-expected inflation with a rising unemployment rate, which reached 4.5% in September

For mortgage holders, the inflation spike means no near-term relief on repayments. The RBA is unlikely to cut rates until it sees clear evidence that inflation is sustainably within its target range. Businesses, meanwhile, continue to face higher wage costs and energy bills, which risk being passed on to consumers.

Consumer inflation expectations have also edged higher, reaching 4.8% in October 2025, their highest level since June. This suggests households remain wary of persistent price pressures, which could further complicate the RBA’s task. The RBA’s next decision is scheduled for 4 November 2025, but the September CPI figures have effectively locked in a hold. The Bank will now wait for the December quarter inflation report, due in early 2026, before considering any further moves. In the meantime, Australians can expect interest rates to remain steady at 3.6%, while inflationary pressures — particularly from energy and services — continue to weigh on household budgets.