Newsletter – November 2024

The Share Market

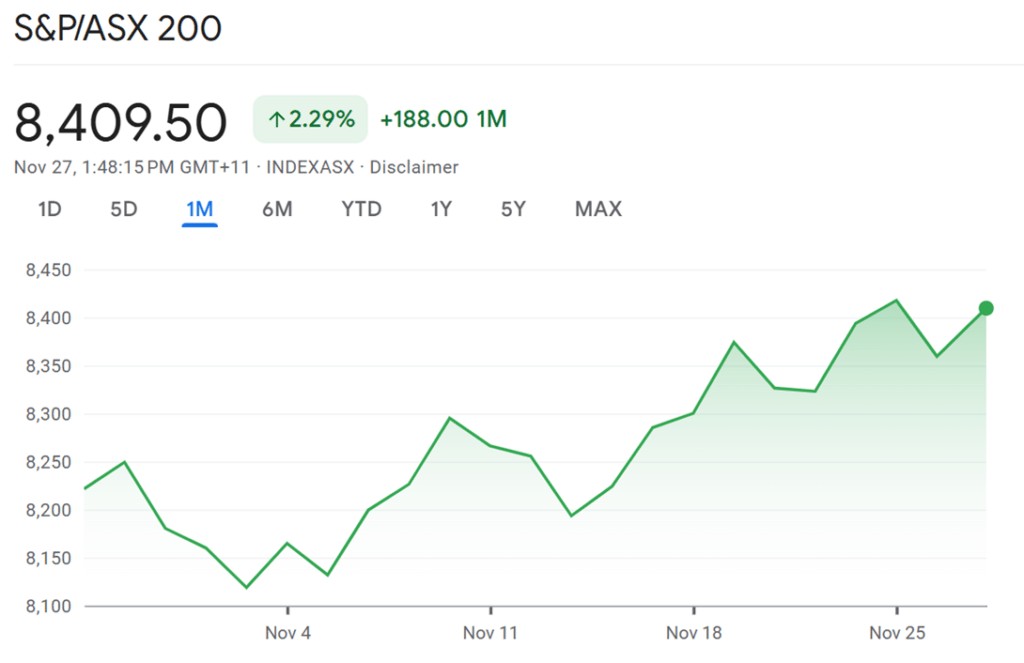

The ASX200 showed a strong upward trend in November 2024, starting at 8,118.80 on 1 November and closing at 8,406.70 on 27 November, representing a solid 3.5% gain for the month. Early November saw relatively stable trading within a narrow range of 8,100–8,200, but momentum picked up mid-month as the index climbed steadily past 8,300. The strongest movements occurred in the latter half, with notable gains on 19 and 25 November, the latter seeing a significant trading volume of over 1.4 million units.

The ASX200's strong upward trend in November 2024, which saw it rise from 8,118.80 to 8,406.70, can be attributed to several key factors that influenced market sentiment and trading activity throughout the month.

The Australian economy showed signs of resilience, with inflation remaining steady and consumer confidence improving. This positive economic backdrop likely encouraged investors to buy into the market, contributing to the index's gains.

A rally in US markets, particularly the S&P 500 (more on this later) and Nasdaq, provided a boost to Australian stocks. The correlation between global markets often leads to increased investor confidence in local equities when international indices perform well.

The ASX200 began the month with stable trading within a narrow range of 8,100–8,200. This stability may have created a foundation for future growth as investors assessed their positions before making larger commitments.

By mid-November, momentum picked up significantly as the index surpassed the 8,300 mark. This surge was likely driven by heightened trading volumes, particularly on notable days like November 19 and November 25, when trading volumes exceeded 1.4 million units. Increased trading activity often signals strong investor interest and can lead to further price increases as more participants enter the market.

Various sectors contributed to the overall performance of the ASX200. Notably, consumer discretionary stocks reached record highs early in the month before experiencing some volatility. This sector's performance often reflects consumer spending trends and can significantly impact overall market sentiment.

Global geopolitical tensions, particularly in Europe and changes in US trade policies under President Trump, influenced investor behaviour. While such factors can create uncertainty, they also led some investors to seek opportunities in Australian equities as a relatively stable investment option compared to more volatile global markets.

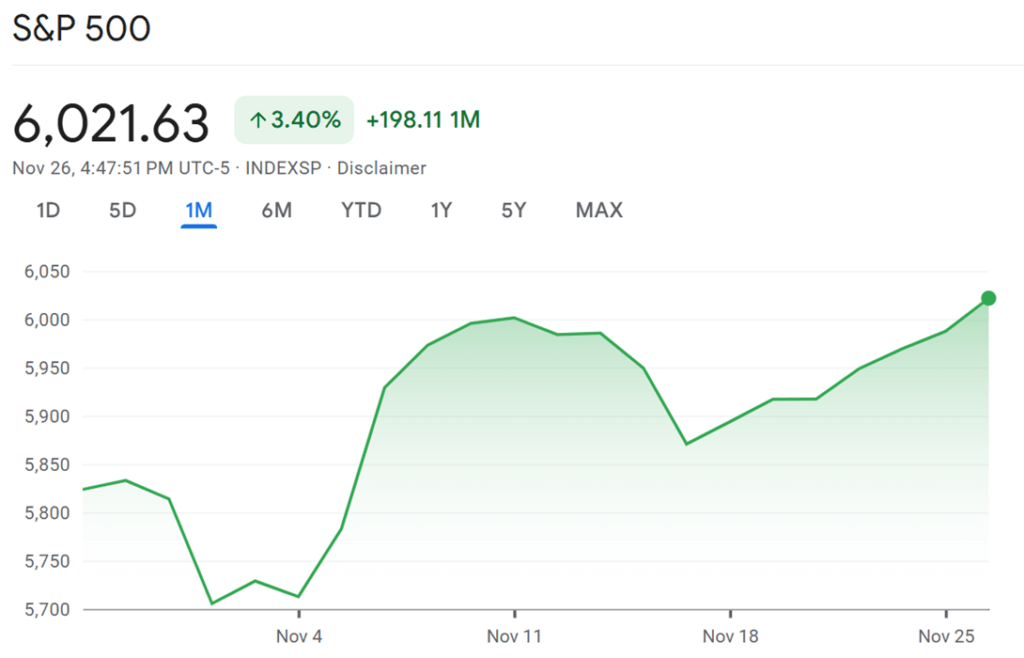

The S&P 500 has shown notable performance in late November 2024, closing at 6,021.63 towards the month end after starting at 5,728.80. This upward trend reflects a series of factors that have influenced market dynamics during this period.

Donald Trump's victory in the recent election has had a significant impact on financial markets, particularly evident in the S&P 500's performance the day following his win. The index surged, reflecting a wave of investor optimism and confidence in the economic policies anticipated under his administration.

Trump's election is often associated with pro-business policies, including tax cuts and deregulation. Investors typically respond positively to these policies as they can lead to increased corporate profits and economic growth.

Leading up to the election, markets were volatile due to uncertainty surrounding the outcome. Trump's win removed this uncertainty, leading to a swift rebound as investors rushed to capitalise on expected market-friendly policies.

Certain sectors, such as financials and energy, tend to benefit from Trump's policies. The anticipation of deregulation in these industries likely spurred buying activity, contributing to the overall rise in the S&P 500.

We also note the following influencing factors:

- Resilient Economic Data: Positive macroeconomic indicators, including employment figures and consumer spending, have bolstered investor confidence. The economic environment appears stable, encouraging investment in equities.

- Interest Rate Speculation: Investors are closely monitoring the Federal Reserve's stance on interest rates. Any signals of maintaining or lowering rates can lead to increased investment in stocks as borrowing costs remain low.

- Strong Earnings Reports: Many companies within the S&P 500 have reported better-than-expected earnings, which has driven stock prices higher. This trend reassures investors about the profitability and growth potential of major corporations.

- High Trading Volumes: The trading volume has remained robust, particularly on significant days like November 25, which saw over 5.6 billion shares traded. High volumes often indicate strong investor interest and can lead to further price increases.

A comment on the impact of the US election

In the wake of Donald Trump's election victory, financial markets experienced a notable swell, prompting many to reflect on the intricate relationship between politics and economics. One interesting anecdote comes from the 2016 election, where similar market reactions were observed. On that occasion, the initial shock of Trump's win led to a brief market dip, only to be followed by a significant rally as investors recalibrated their expectations of pro-business policies.

This raises a thought-provoking question: How much do political events truly influence market behaviour, and can investor sentiment shift so rapidly that it overshadows fundamental economic indicators? As we witness these fluctuations, it’s essential to consider whether markets are driven more by emotional responses to political news rather than by underlying economic realities. This interplay between perception and reality continues to shape our understanding of market dynamics and investor behaviour.

The Residential Property Market

The Australian residential property market has experienced a notable shift in dynamics during October and November 2024. The latest data reveals a cooling trend across major capital cities, with varying impacts on home values, sales activity, and rental markets. Let's review some of the significant highlights from the November 2024 CoreLogic HVI report.

Overview of Home Values

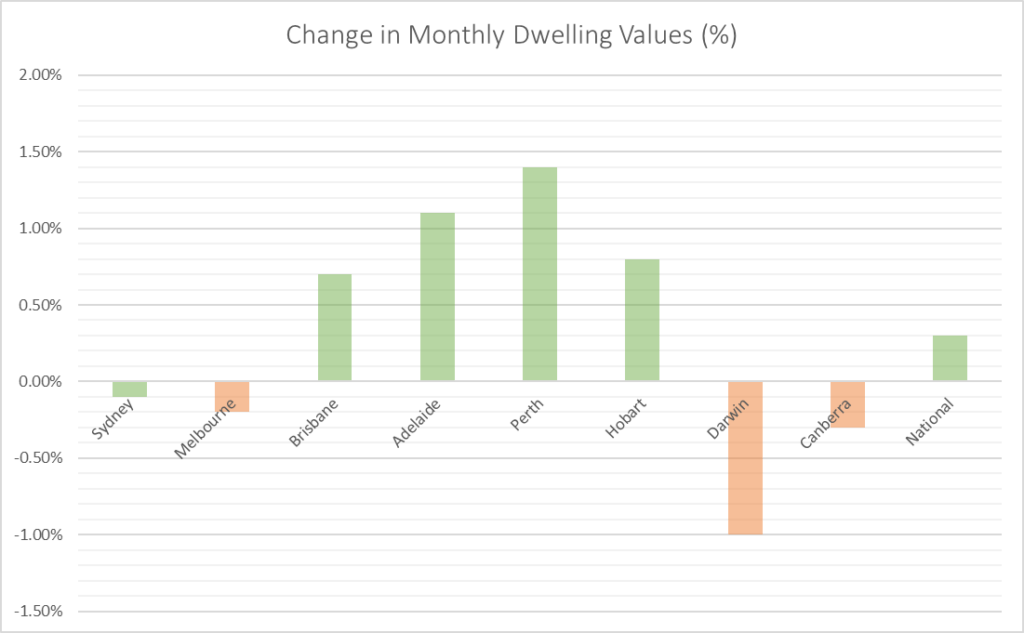

In October, the national Home Value Index (HVI) recorded a modest increase of 0.3%, marking the 21st consecutive month of growth since February 2023. However, this overall figure masks significant regional variations:

- Perth led the growth with a 1.4% rise in values.

- Other capitals like Adelaide and Brisbane saw increases of 1.1% and 0.7%, respectively.

- Conversely, major declines were noted in Darwin (-1.0%), Canberra (-0.3%), Melbourne (-0.2%), and notably Sydney, which experienced its first monthly decline since January 2023 at -0.1%.

- Hobart rebounded with a 0.8% increase in dwelling values for October from -0.4% in the month prior.

Annual growth rates have also moderated, with national home values increasing by 6.0% over the past year, down from a peak of 9.7% earlier in the cycle.

Market Dynamics

The cooling market conditions are attributed to several factors:

- Increased borrowing costs and affordability challenges have shifted buyer interest towards more affordable housing segments. In Sydney, for example, lower quartile house values rose by 0.5%, while upper quartile values fell by -0.6%.

- The number of homes for sale has surged, with advertised inventory up by 12.7% since winter's end across combined capitals. This rise is particularly pronounced in Perth, where listings jumped by 20.6% from low levels.

- Sales activity has also declined, with estimates indicating a 7.5% drop in capital city sales over the last three months compared to the previous quarter.

Rental Market Trends

The rental market is showing signs of softening as well:

- National rents rose by just 0.2% in October, with annual growth slowing to 5.8%, the lowest since April 2021.

- Notably, rental prices for units have decreased in several major cities including Sydney (-0.6%) and Melbourne (-0.4%) over the past three months.

- Gross rental yields have fallen to 3.47%, down from a high of 3.52% earlier this year, reflecting pressure on returns for investors amidst rising costs associated with property maintenance and higher mortgage rates.

Future Outlook

Looking ahead, several factors could influence the housing market:

- The recent easing in inflation rates may lead to potential interest rate cuts early next year, which could support housing prices.

- However, persistent affordability issues remain a challenge as debt servicing ratios reach record highs and household incomes struggle to keep pace with rising dwelling values.

- Construction activity continues to lag behind demand, with dwelling approvals below average and a diminishing number of projects underway due to feasibility challenges and tight labour supply.

In summary, while certain regions like Perth and Adelaide continue to show resilience in home value growth, the overall Australian residential property market is experiencing a cooling phase characterised by increased inventory levels and declining sales activity. As economic conditions evolve, stakeholders will need to monitor these trends closely to navigate the changing landscape effectively.

Inflation and Interest Rates

In November 2024, the Reserve Bank of Australia (RBA) decided to keep the cash rate at 4.35% for the eighth month in a row. This choice reflects a careful approach as the economy faces various challenges, particularly regarding inflation and consumer spending.

Current Economic Situation in Australia

The RBA's decision to hold the cash rate steady is part of its effort to manage inflation. While inflation has dropped to 2.8%, the lowest it has been in nearly four years, underlying inflation remains a concern at 3.5%. This means that while prices are starting to stabilise, they are still higher than the RBA’s target range of 2-3%. The bank is being cautious, wanting to ensure that inflation continues to move in the right direction.

There are signs that household spending is picking up as we approach the end of 2024. However, the RBA warns that this increase might not be as strong as expected, which could slow down overall economic growth and affect job creation.

Looking Ahead

Economists have mixed opinions about what will happen with interest rates in the future. Some believe that we might see rate cuts starting in early 2025, while others think rates could stay high for longer due to ongoing inflation and a tight job market. The RBA has indicated that any future changes will depend on how the economy performs.

Impact of the Recent US Election

The recent US election, which resulted in Donald Trump returning to the presidency, is likely to have effects on global economic conditions, including Australia’s. Trump’s proposed policies could lead to higher inflation in the US because of expected tax cuts and increased government spending. If this happens, the Federal Reserve may raise interest rates further, which could influence financial markets worldwide and potentially affect Australia’s monetary policy.

While Australia is somewhat shielded from direct impacts of US policies, changes in global trade and currency values could still affect its economy. If tariffs are imposed on imports from countries like China, it could slow down economic growth there and reduce demand for Australian exports.

Conclusion

As Australia faces these economic challenges, the RBA remains focused on keeping prices stable while supporting growth. The relationship between local monetary policy and international events will be important as policymakers consider their next steps in this uncertain environment. With interest rates held steady for now, attention will be on upcoming data and global trends that could shape future decisions. Economists suggest that while there may be short-term boosts to economic activity due to Trump's policies, long-term effects could include higher national debt and persistent inflation, necessitating higher interest rates. This scenario would likely push Australian interest rates up as well due to interconnected global financial markets.